Linking

One important advantage of emission trading as an instrument to tackle climate change is that it is feasible to connect systems across borders. This “linking” of two or more ETSs creates a larger carbon market, which can provide the participating regions with more cost-efficient options to reduce their emissions. Linking can be done either directly or indirectly and can lead to price convergence, thus offering efficiency gains. There are however important compatibility issues with corresponding regulatory and governance consequences to be taken into account when considering linking.

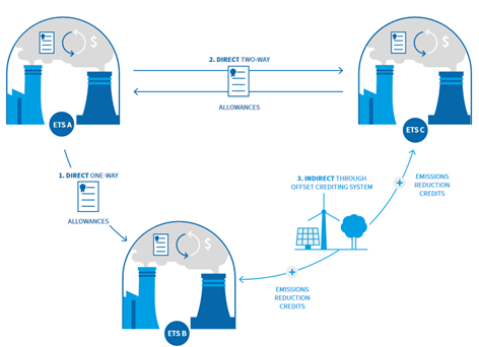

Through linking, different systems create a direct or indirect connection with each other. Systems link directly if emission allowances of one scheme can be surrendered in another. This can be done either bilaterally where both systems’ allowances can be used in either system, or unilaterally if this is only the case in one system. Systems can also link indirectly, for example through the common acceptance of an offset standard (such as the CDM). Linking offers the most potential benefit if different systems have different mitigation options and therefore different price levels. Full linking creates a single carbon price in all participating systems and makes the cheapest mitigation options available to all participants in the linked system. While allowance prices would rise in the previously cheaper non-linked system, linking would increase demand to make sure more efficient mitigation options are exploited. A larger market will also tend to be more liquid, which may increase resilience to manipulation and external shocks.

While a larger linked system would be able to take advantage of more mitigation options, all design elements, but also other factors such as political decisions and economic developments in every jurisdiction become variables in the larger market. Ensuring compatibility of design features across systems is therefore very important. Monitoring, reporting and verification standards to ensure that ‘a ton is a ton’ are a key prerequisite for a common market. Other important issues include the use of offsets and so-called safety valves (e.g., price ceiling/floor) to regulate allowances prices. Differences regarding other design features, such as cap stringency, allocation/revenue provisions, or sector coverage can more readily be accommodated. For policymakers, linking means a loss of regulatory flexibility and control on a regional level, emphasizing the need for close coordination between linked systems.

Prominent examples for successful linkages are those of the EU ETS with the Swiss ETS and the California Cap-and-Trade Program with the Québec Cap-and-Trade System.

For further information, see:

- Step 9 of ‘Emissions Trading in Practice: A Handbook on Design and Implementation’ by the PMR & ICAP

- ICAP ETS Brief # 4