Flexibility Provisions

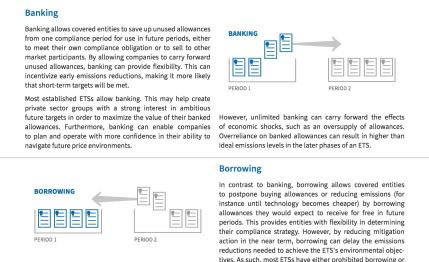

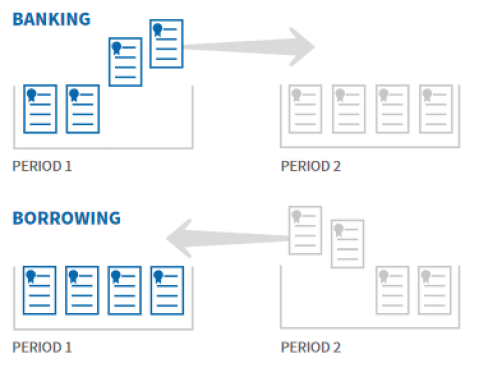

There is a range of options that can provide additional flexibility for covered entities in an ETS to comply with the system. Temporal flexibility provisions, such as banking and borrowing, can provide the option to take advantage of mitigation options outside established compliance periods, whereas other credits such as offsets expand mitigation options beyond covered regions and/or sectors covered by an ETS.

Banking or borrowing provisions can help address market fluctuations through time due to developments such as economic fluctuations, abnormal weather, or technological developments. “Banking” provisions allow entities to hold surplus allowances from previous trading periods, when mitigation may have been easier, and to surrender them in future compliance periods, when it may be more expensive. Alternatively, if future mitigation costs are lower, for example through new technology, entities may “borrow” allowances to surrender in the present, which are then deducted from their future budgets. In both cases, it is important that emissions remain under the cap across various trading periods.

The location and sector where GHGs are emitted are irrelevant for climate change on the global level. The costs of mitigation actions, however, may be lower in regions or sectors not covered by the cap. Therefore, offering covered entities the opportunity to contribute to emission reduction projects outside the sectoral or geographic scope of an ETS may reduce compliance costs without compromising environmental integrity. An example of an international mechanism that some ETS jurisdictions have decided to recognize as an offset credit (subject to quantitative and qualitative limits) is the Clean Development Mechanism (CDM) established under the Kyoto Protocol. Other systems have developed their own offset options focusing on domestic mitigation. Important criteria for offsets are their additionality, permanence, and leakage: offsetting must demonstrate actual emission reductions compared to what would have otherwise happened, and ensure emissions are not simply released at a later date, or displaced elsewhere.

For further information, see:

- Steps 6 & 8 of ‘Emissions Trading in Practice: A Handbook on Design and Implementation’ by the PMR & ICAP

- ICAP ETS Brief # 8