Allocation

Allocation

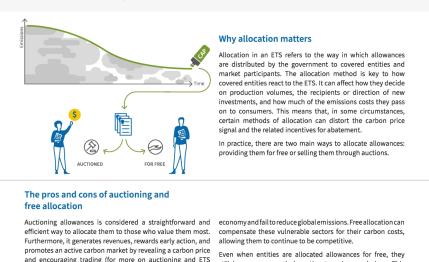

Allocation is the process of distributing allowances to covered entities in an emissions trading system. There are two basic options for allocation: allowances can be either given away (freely allocated) or sold, often by auction. Because allowances have a value, the allocation process is governed by rules to ensure their fair distribution. A simple, transparent and credible process facilitates this politically contentious part of operating a trading scheme.

Two methods are common in the context of free allocation of allowances: grandparenting and benchmarking. With grandparenting, covered entities receive emission allowances according to their historical emissions in a base year or base period. Grandparenting tends to increase the political feasibility of emissions trading as it avoids high initial costs for covered sectors. As an allocation method however, grandparenting tends to reward historically high emitters and requires further provisions for new entrants (i.e., emitting facilities that join the system after its initial establishment). The other method is benchmarking, where allowances are allocated according to performance indicators. Benchmarking rewards efficient installations and can more easily assimilate new entrants. Allocation rules can be adjusted to give out only a portion of allowances for free, but in each case, a system should have reliable emissions data and clear allocation formulae for sectors and/or installations.

Selling allowances, usually by auction, has the advantage of reflecting the actual need of installations for allowances and gives covered entities equal opportunity to buy allowances. Moreover, it raises revenues for the regulator that can then be spent on other measures to address climate change. Auctions, sometimes referred to as forming the primary market, are generally conducted either via static “blind” or “sealed bid” auctions, where all bidders bid once and pay the same price; or by dynamic “ascending clock” auctions where each bidder pays closer to what they are willing to pay as revealed through multiple rounds. These processes and variations thereof foster transparent discovery of allowance prices based on the demand of covered entities. Auction design and participation rules may further help in preventing manipulation through collusive behavior through groups of bidders and limit the market power of single large buyers.

For further information, see:

- Step 5 of ‘Emissions Trading in Practice: A Handbook on Design and Implementation’ by the PMR & ICAP

- ICAP ETS Brief # 1: What is Emissions Trading?

- ICAP ETS Brief # 6: Emissions Trading Revenue

- ICAP ETS Brief # 5: Allocation of Allowances