Emissions Trading Worldwide: 2022 ICAP Status Report

Category

Topics

Release date

Language

Emissions trading takes the center stage as a key tool to meet net-zero goals

Emissions trading continued to gain momentum in 2021, and is increasingly becoming a key tool to deliver the decarbonization required to fulfil long-term net zero ambitions, finds the International Carbon Action Partnership (ICAP)’s Emissions Trading Worldwide Status Report for 2022

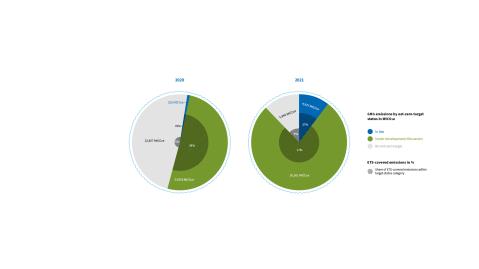

- Around 90% of global emissions are now subject to a net-zero target

- Over one third of GHG emissions in jurisdictions with net-zero targets enshrined in law are covered by an ETS

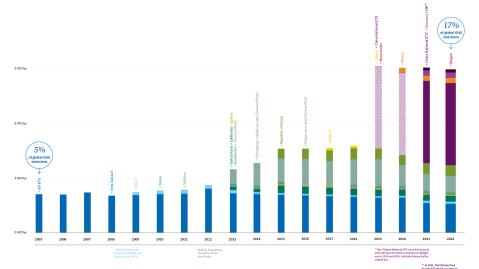

- The 25 operational ETSs as of the start of 2022 cover 17% of global GHG emissionsand are implemented in jurisdictions representing 55% of global GDP

- Almost one-third of the world population lives under an ETS in force

- Cumulatively, ETSs have raised $161 billion globally as of the end of 2021, an increase of more than 50% from the previous year

Emissions trading systems can play a vital role in realizing the needed decarbonization to reach net zero by mid-century, by incentivizing investments in technologies and supporting the most vulnerable communities with the low-carbon transition.

As of the start of 2022, there are 25 operational emissions trading systems around the world, in jurisdictions representing 55% of global GDP. These systems cover 17% of global emissions, according to the ninth ICAP Status Report. These 25 systems cover 37% of emissions captured by net-zero targets enshrined in law, and 17% of those under discussion – with a further 22 trading systems under development or consideration.

“Emissions trading can play a key role in decarbonizing economies and must form a part of net-zero plans,” says Stefano De Clara, head of the ICAP Secretariat. “We know some of the technologies the world will need to get to net zero by mid-century – and we know that emissions trading sends a crucial price signal to deploy emission reduction and removal technologies.”

He adds: “The temptation to pull back from climate ambitions is great at the present times, as governments grapple with soaring inflation and energy prices. However, this would be a mistake and delaying the low-carbon transition would set the stage for further crises and price crunches in the future. The push to net zero is a huge opportunity for innovation, and emissions trading can help”

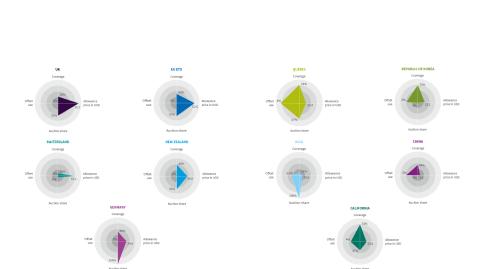

Alongside infographics and updated detailed factsheets on the world’s carbon markets, this year’s Status Report also features high-level articles on the performance so far of new systems in China and the UK, why and how the EU ETS should expand to the maritime sector, and how California is ensuring its carbon market facilitates a just transition. Other pieces include how interest in carbon pricing is growing across the Americas and how to translate net-zero goals into policies to deliver emissions reductions.

“Reaching net-zero emissions by or around mid-century is now a common goal covering the vast majority of the global economy,” says Dirk Weinreich, ICAP Co-Chair and Head of Division of Climate Legislation and Emissions Trading, Federal Ministry for Economic Affairs and Climate Action, Germany. “ETSs are well suited to achieving this ambition: they provide both assurance over emissions levels and longer-term market signals needed to stimulate the investment necessary to enable the low-carbon transition. Implementing carbon pricing policies on a global scale would have the dual benefit of increasing the efficiency of climate change measures and safeguarding the increased climate ambition of pioneering jurisdictions.”

“The net-zero transition will see the winding down of some carbon-intensive industries and the expansion of new, low-carbon ones,” says Rajinder Sahota, ICAP Co-Chair and Deputy Executive Officer – Climate Change and Research, California Air Resources Board. “The potential for zero carbon growth is significant. Nevertheless, for this transition to succeed it must be just and leave no one behind. Since the beginning we have used a portfolio of incentives, regulations, and carbon pricing. This was also the recommendation by our community representatives. The design of carbon pricing programs and reinvestment of funds can help ensure the most vulnerable are protected from negative impacts due to this transition, and in doing so advance effective, and long-lasting climate action.”

The Status Report was the topic of two webinars on 29 March (4pm CEST) and 30 March (9am CEST). The recordings are available below.

Stefano De Clara

The temptation to pull back from climate ambitions is great at the present times, as governments grapple with soaring inflation and energy prices. However, this would be a mistake and delaying the low-carbon transition would set the stage for further crises and price crunches in the future. The push to net zero is a huge opportunity for innovation, and emissions trading can help.

Rewatch the first launch webinar for the ICAP Status Report 2022, focusing on recent developments in the Americas and Europe.

Rewatch the second launch webinar for the ICAP Status Report 2022, focusing on recent developments in the Asia-Pacific region and Europe.