The European Union has formally adopted a broad set of laws to implement the “Fit for 55” policy package, including a landmark reform of the EU ETS. The final texts for five legislative proposals were adopted by the European Parliament on 18 April and then by the Council on 25 April 2023. This represents the last step in the EU’s decision-making process.

The European Commission, the European Parliament, and the Council of the EU completed ‘trilogue’ negotiations in December 2022, reaching a provisional agreement on the main climate policy reforms. On other parts of the package, including the Carbon Border Adjustment Mechanism (CBAM), consensus had already been reached. Originally presented by the European Commission in July 2021, the "Fit for 55" reforms are needed for the European Union to meet its emissions reduction target of 55% by 2030 and to achieve climate neutrality by 2050.

The reforms represent a defining milestone for the EU ETS, and for carbon pricing more broadly, effectively placing emissions trading at the heart of the EU’s decarbonization agenda. Building upon the 2030 Climate Target Plan, the deal includes a more ambitious reduction target for the EU ETS sectors of 62% by 2030; the phase out of free allocation in some sectors accompanied by the phase-in of the CBAM; revised parameters for the Market Stability Reserve (MSR); the expansion of the EU ETS to cover maritime shipping; a new and separate ETS for buildings, road transport, and additional sectors (ETS 2); and a strengthened commitment to use ETS revenues to address distributional effects and spur innovation. The key elements of the policy reforms are outlined below.

EU ETS cap, trajectory, and rebasing

To achieve the target of at least 55% net reduction in greenhouse gas emissions below 1990 levels by 2030, as outlined in the European Climate Law, co-legislators committed to greater emissions reductions under the EU ETS, setting a target of 62% below 2005 levels by 2030. This is an increase compared to the 61% target originally proposed by the European Commission in the “Fit for 55” proposal, and a significant increase from the previous 43% target. To accomplish this, the reform raises the linear reduction factor (LRF) from 2.2% to 4.3% from 2024-2027 and to 4.4% from 2028-2030. Furthermore, the reform includes two one-off ‘rebasings’ of the cap, reducing it by 90 million allowances in 2024 and an additional 27 million in 2026.

Carbon Border Adjustment Mechanism (CBAM)

To address higher risks of carbon leakage in light of increased climate ambition within the EU, the Council and Parliament agreed on a phase-in plan for CBAM to price imported goods based on their embedded emissions. Starting in 2026, importers in sectors covered by CBAM (cement, aluminum, fertilizers, electricity, hydrogen, iron and steel, along with some precursors and downstream products) will be required to surrender newly created CBAM certificates equivalent to the embedded emissions of their products. In contrast to the original Commission proposal, indirect emissions from electricity and heat will also be covered for cement and fertilizers.

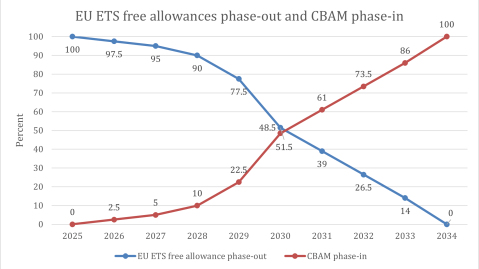

The CBAM phase-in plan gradually ceases the free allocation of EU ETS allowances over a nine-year period (from 2026 to 2034) for sectors covered by CBAM. The phase-out of free allocation will begin at a slow rate before accelerating towards the end of the period. It will also correspond directly to the CBAM phase-in, so that during the transition period CBAM will only apply to the proportion of emissions that are not subject to free allocation under the EU ETS.

Source: own illustration based on European Commission

EU ETS market stability reserve (MSR)

The MSR is the main instrument for addressing supply and demand imbalances in the EU ETS and bolstering its resilience to external shocks. Allowances are transferred from the auction volume to the reserve whenever the total number of allowances in circulation (TNAC) is higher than 833 million. The MSR will be strengthened by maintaining the annual allowance intake rate at 24% of the TNAC until 2030 (initially scheduled to be reduced to 12% from 2023 onwards). Furthermore, the agreement will restrict the number of allowances that can be held in the reserve to 400 million, with any surplus being permanently cancelled.

EU ETS scope expansion

The reform entails the phasing in of maritime sector emissions into the EU ETS, with the obligation to surrender allowances rising from 40% of verified emissions in 2024 to 100% in 2026. All emissions from intra-EU voyages and within EU ports will be covered by the ETS, and 50% of the emissions for journeys to or from a non-EU country. By the end of 2026, the Commission will also assess whether to introduce emissions from municipal waste incineration into the EU ETS from 2028.

New ETS for buildings, road transport, and additional sectors

In parallel, the agreement establishes a separate emissions trading system for direct emissions from the buildings, road transport, and additional sectors (mainly small industry not already covered by the EU ETS). The new ETS 2 will complement the EU ETS sectoral coverage, broadening EU-level carbon pricing to cover all major sectors of the economy except agriculture and land-use. In light of the impact of the energy crisis, the new system is set to come into force in 2027. However, as a means of safeguarding vulnerable households, the ETS 2 will be delayed to 2028 if energy prices are deemed exceptionally high.

To give the new system a smooth start, it was agreed to frontload the supply of allowances by auctioning an additional 30% in the first year of operation. A new price stability mechanism has also been agreed, so that if the allowance price exceeds EUR 45 per tonne over a period of two consecutive months, market supply shall be increased by releasing an additional 20 million allowances from a separate section of the MSR created for this purpose. In the case that the allowance price dramatically increases over a period of three consecutive months, additional allowances will also be released.

ETS revenue use

Revenues from the ETS 2 will flow into a newly established Social Climate Fund. This fund is intended to address the financial burden of citizens and micro-enterprises most impacted by energy price rises, particularly for heating and transport, resulting from the new carbon price. The EU ETS’s existing Innovation Fund is also set for a significant boost, with funding (coming from the auctioning of dedicated allowances) rising from 450 million to 575 million allowances in the period 2020-2030.

Next steps

The laws will now be signed by the Council and the European Parliament and published in the EU’s Official Journal before entering into force. The reforms set out in the revised ETS Directive will apply from 1 January 2024, while the Social Climate Fund will officially come into operation on 30 June 2024. The CBAM Regulation will apply from 1 October 2023 (reporting obligation), however the full compliance obligation for importers will only apply from 1 January 2026. The new ETS 2 will come into force in either 2027 or 2028, depending on energy prices.